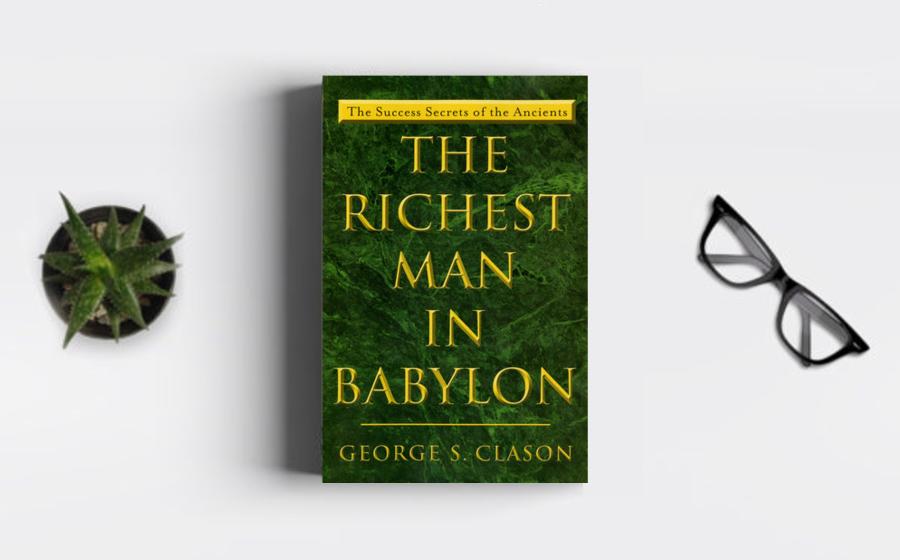

"The Richest Man in Babylon" by George S. Clason is a

classic personal finance book that offers timeless

principles for achieving financial success. Set in

ancient Babylon, the book presents a collection of

parables and stories that revolve around the core

principles of money management and wealth building.

Through the experiences of various characters, the

author imparts valuable lessons on saving, investing,

and making wise financial decisions.

The central

theme of the book is the importance of taking control of

one's financial destiny and applying simple yet powerful

principles to build wealth. The narrative is structured

as a series of conversations between a wise and wealthy

man named Arkad and a group of individuals eager to

learn the secrets of financial prosperity. Arkad shares

his wisdom by recounting his own journey from a humble

scribe to the richest man in Babylon.

One of the

key lessons emphasized in the book is the principle of

saving a portion of one's income. This is exemplified

through the story of Arkad's childhood friend Algamish,

who imparts the wisdom of saving at least 10% of one's

earnings. The concept of "paying yourself first" is a

cornerstone of personal finance, encouraging readers to

prioritize saving before allocating money to other

expenses.

The book also stresses the importance

of making informed and strategic investments. Arkad

emphasizes the need to put money to work and to seek

opportunities that provide a reasonable return on

investment. The parable of the gold lender showcases the

potential for wealth accumulation through careful and

calculated investments.

Additionally, "The

Richest Man in Babylon" advocates for seeking sound

financial advice and learning from those who have

achieved success in the realm of money management. The

characters in the book often turn to Arkad for guidance,

highlighting the value of mentorship and learning from

those with proven expertise.

Another significant

principle is the avoidance of debt and the importance of

living within one's means. The book warns against

borrowing for non-productive purposes and encourages

readers to prioritize financial stability over impulsive

spending. The parable of the five laws of gold outlines

fundamental principles such as ensuring a profitable

return on investments and guarding against loss.

Furthermore, the book delves into the psychology of

wealth and the mindset required to attain financial

success. It emphasizes the role of discipline,

perseverance, and the ability to resist immediate

gratification in the pursuit of long-term financial

goals. The parable of the camel trader illustrates the

consequences of succumbing to the temptation of quick

riches without careful consideration.

"The

Richest Man in Babylon" employs engaging storytelling to

convey its financial wisdom, making the lessons

accessible and relatable. The use of ancient Babylon as

the backdrop adds a layer of intrigue and timelessness

to the principles presented. The stories are woven with

vivid imagery and memorable characters, enhancing the

overall impact of the lessons.

The book's

enduring popularity can be attributed to its simplicity

and applicability across different economic and cultural

contexts. The principles outlined in the book are not

bound by time or place, making them relevant to readers

of various backgrounds and experiences. The universal

nature of the lessons ensures that the book remains a

valuable resource for individuals seeking to improve

their financial well-being.

In terms of

inspiration, "The Richest Man in Babylon" motivates

readers to take proactive steps toward financial

empowerment. The success stories and practical advice

instill a sense of hope and possibility, demonstrating

that financial success is attainable through disciplined

and principled actions. The book serves as a call to

action, urging readers to assess their financial habits,

set goals, and implement the timeless principles

outlined in its pages.

Moreover, the book

encourages a shift in mindset from a focus on immediate

consumption to a long-term perspective on wealth

creation. By illustrating the consequences of poor

financial decisions and the rewards of prudent choices,

"The Richest Man in Babylon" inspires readers to adopt a

more strategic approach to their finances.

"The Richest Man in Babylon" is a compelling and enduring guide to financial success. Its timeless principles, conveyed through captivating stories set in ancient Babylon, continue to inspire and empower readers to take control of their financial destinies and achieve lasting financial prosperity.